INTERNATIONAL MARKET REPORT

03/28/2025

MEXICO

MARKET PULSE

(SOURCE: WSTFA)

Feedback from the Trade on Their Plans and Interest in the USA Pear Season:

Importers are interested in continuing to import USA Pears. They are looking for 100 and 110 sizes, which are the most demanded, but the market could handle other sizes if price is affordable, which is still the main limiting factor to increasing volumes imported. While importers mentioned that price at origin and volumes available will impact their purchase decisions, importers will continue importing USA Pears as long as they are available. Even though other origins have started to become available, Northwest pears maintain higher levels of demand, even when prices at wholesale are high. Sales of USA Pears were good, with 93% pear market share at wholesale, 93% at supermarket stores and 99% at traditional channels.

Expectations for Any Freight or Logistics Challenges:

Until now, there is not any challenges related to freight or logistics challenges.

Opportunities in Your Market for Specific Varieties, Sizes, and Grades:

Mexico is an elastic market and can handle different varieties, sizes, and quality grades. Price at origin will remain as the main factor that could affect purchasing decisions. In some varieties that have a higher price, importers prefer to handle half-box presentation in order to reduce the price at wholesale level.

Update on the Competition in the Market:

Pears from China were available at wholesale with 3% pear market share, 5% in retail stores, and 1% at traditional channels; quality was good but low sales due to price. Pears from Argentina were available at wholesale level with 1% pear market share. Quality was good and good sales were reported. It is expected that volumes will increase in the next month. Pears from Chile were available at wholesale with 3% pear market share and 2% in supermarket stores. Quality and sales were reported as good, and volumes are expected to increase for the upcoming period. Some retailers are mixing the different Green Anjou origins (Chile, Argentina and NW) in their pear displays.

Political or Economic Issues Impacting Imports, Retail, or Consumer Behavior:

Importers expect to find out if retaliatory tariffs will be applied to fresh pears by the Mexican government after April 2 if the U.S. applies tariffs to Mexico exports. At that point they will need to decide how they could work with their suppliers to adjust prices to reduce the impact on Mexican customers and clients.

Other Brief Comments:

No other comments for this period.

USA PEARS: RETAIL PRICING, SIZES, AND GRADES

-

US1: 58%

-

Fancy: 25%

-

3rd Grade: 17%

COMPETITION: RETAIL PRICING AND SIZES

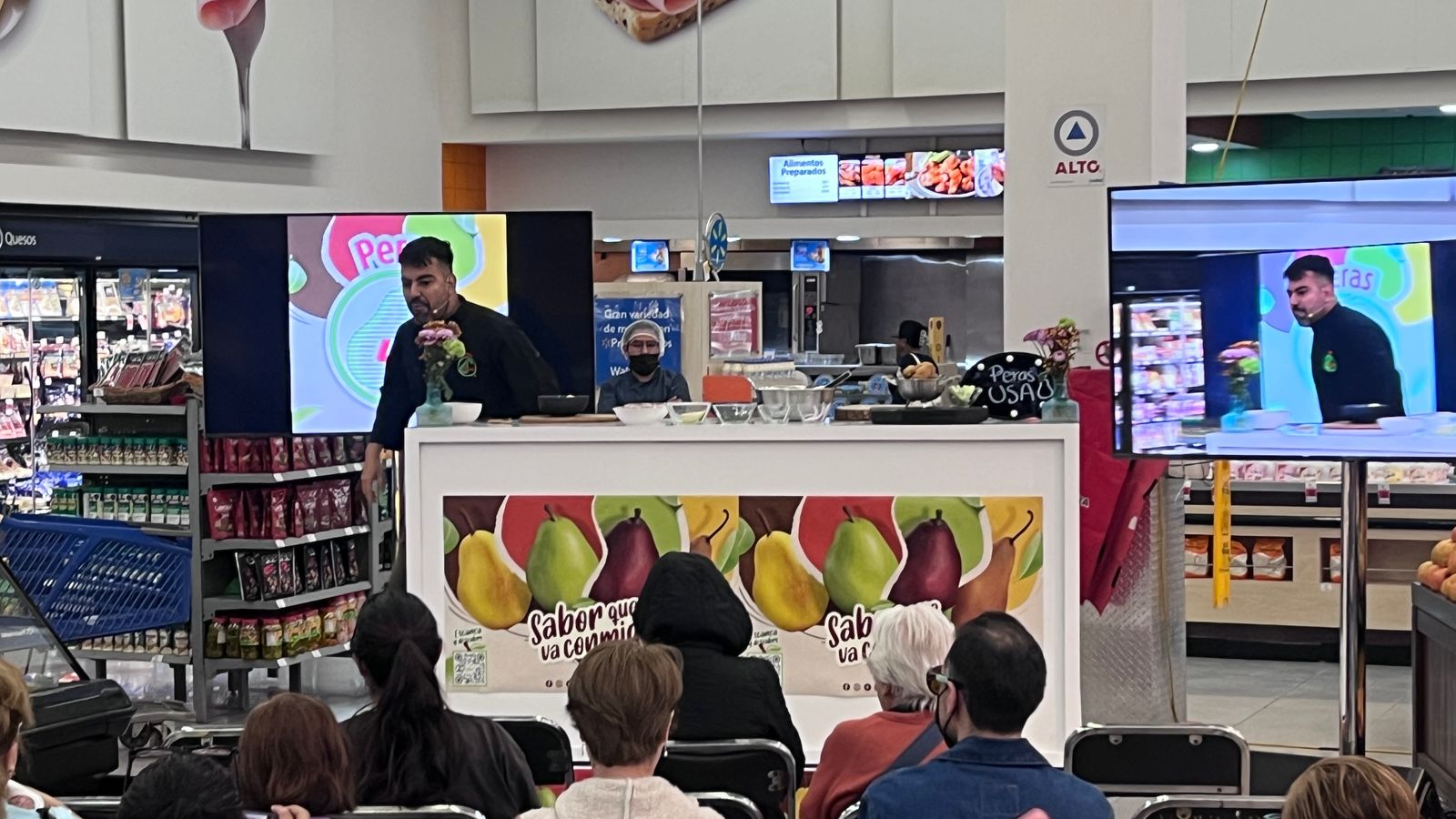

UPCOMING ACTIVITIES